Back to basics - our rules for stock market investing (part 2)

Start here if you are new to the stock market

«Stock market experience level: Beginner»

If you are here you’ve thankfully stayed with us for part 2 of this post which is hopefully more of an insightful read. Let us know your thoughts by sharing a comment or reaching out to us directly.

Rule 1 - Have the right goals and expectations

Stock markets on average have delivered c.9-10% return per year when looking over a long time horizon. But as the chart below shows, markets are volatile and have fallen by a double-digit %, a number of times, referred to as a bear market. Thus, unless you are opting for a trading strategy or have very high risk tolerance and limited liquidity needs, you should aim to remain invested for at least 5 years, ideally the longer the better. I've assumed most are investing for longer term goals, retirement etc, as opposed to current income needs but your portfolio should be linked to your financial goals. This should also be reflected in your asset allocation, how much of your wealth you decide to allocate to the different asset classes including Cash (in savings rates), longer term fixed deposits, bonds or sukuk for Muslims, Gold and other commodities, Equities or even Private Equity and Property.

On average we get a bear market every 4.8 years and they last 9.6 months. The chart below clearly shows periods of rising stock prices or bull markets, in blue, are more frequent and last longer. So it should be clear from this that markets travel upwards over the long term!

Rule 2 - Time is your best friend.

This follows on from rule 1 and is a reason I bang on about familiarising yourself with the stock market. Particularly for those who've just started working and probably aren't aware that they are already invested in the stock market through a workplace pension (auto-enrolment became a thing here in the UK in late 2012). Pretty much the only advantage you have over experienced investors like Bill Ackman, Bill Gates or Bill Miller (a lot of Bill's) is time!

‘Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn't...pays it.’ — Albert Einstein

I'm sure we've all heard those mantras, if I invest x for y number of years, I'll be a millionaire and while it might not be great for the financial services industry, past performance shows it does add up. Of course there is no guarantee past performance is going to repeat but the math works and it amazes us how people will continue to overlook the power of compounding and are impatient when it comes to investing.

We can't overlook inflation though, which would mean £1m in 40 years time will actually only be worth £322.5k in today's value of money, assuming inflation is the same over the next 40 year period as it has been in the last, and actually, worryingly, more and more investors think it is more likely to be higher in Western economies due to ageing populations, deglobalisation and the sustainability trend. Nevertheless, this is all the more reason to invest and possibly aim for more active investing to generate greater returns as you gain more confidence (see how we structure our portfolio here).

Yes, you can use the stock market to trade and make short term gains (and we do a bit of this when we know a company well and follow their earnings, or when we see price momentum in markets) but the aim for starters should be to slowly and steadily build wealth and let compounding work its magic. The chart below shows there is a higher probability in generating positive returns, the longer you are invested.

Rule 3 - How much and how often?

We may not all be in the best financial circumstances but really everyone should still be saving/investing according to their circumstances. The 50/30/20 rule is a popular budgeting tool with 50% of after-tax income designated to needs, 30% to wants and 20% to savings and investments. It's not without its critics but it is a good place to start thinking about your finances. Within the 20% designated to saving and investing, a high priority should be to build up a 6 month emergency fund first and then begin investing. Setting up automatic regular deposits into an investing account takes a lot of the time and effort out of investing. Moreover, ‘mental accounting’ is such that automatic deposits make it easier to manage to a tighter budget and spend less on frivolous things - honestly, try it out.

‘There are only two types of people when it comes to market timing: (1) People who cannot do it, (2) People who have not realized that they cannot do it.’ — Terry Smith, Fundsmith

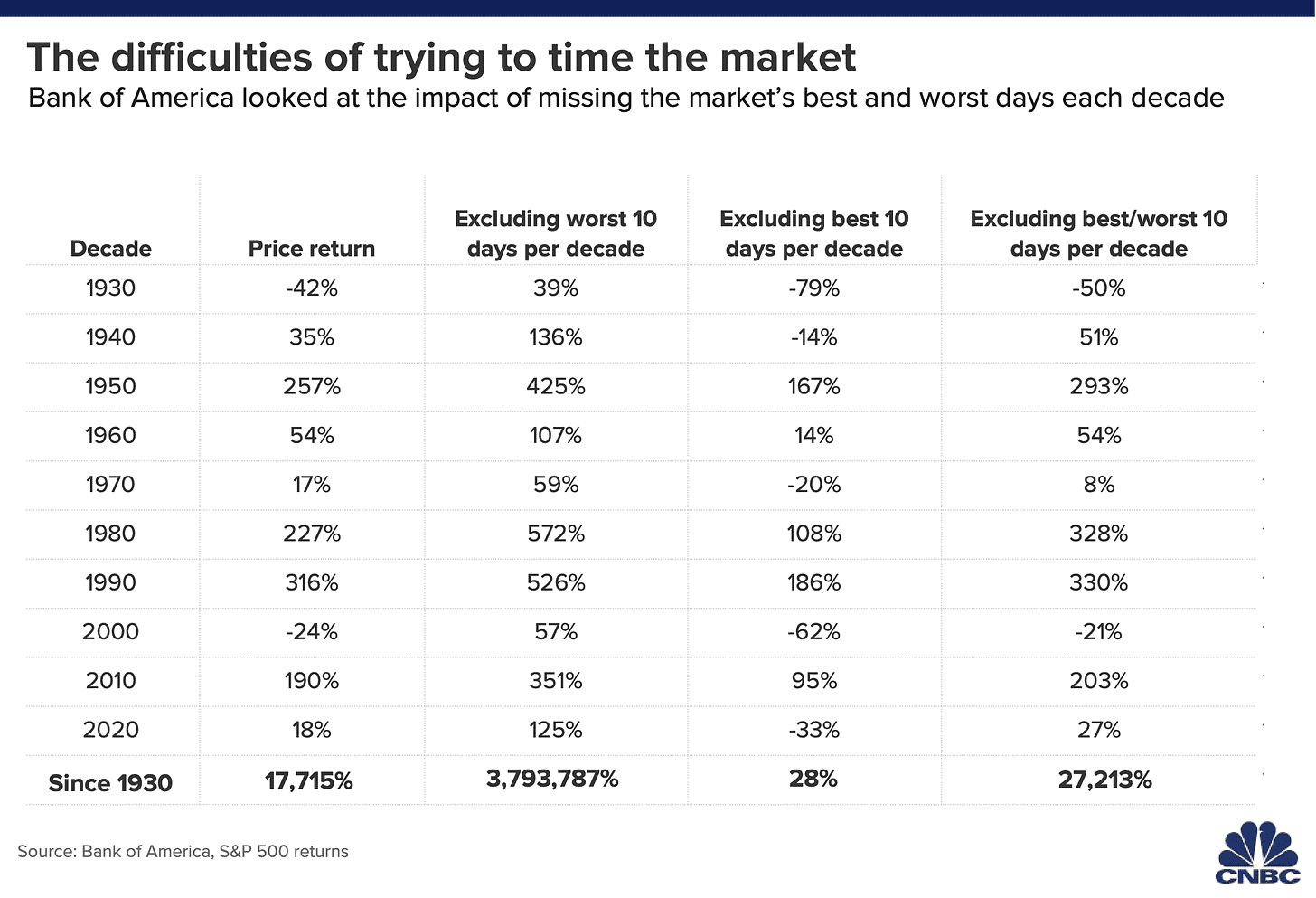

Dollar cost averaging (or pound or rupee, whatever currency you use!) helps smooth out the market volatility we spoke about in Rule 1. There is vast amounts of evidence that timing markets, that is depositing/withdrawing funds at certain times and into certain markets based on analysis, is too difficult of a task to do consistently. It is clear how difficult it would be from the table below where a study was conducted by Bank of America, which shows significantly different performance when excluding only the 10 best and worst days for each decade. Instead, you should keep to your asset allocation and we would argue only tactically topping up when market conditions offer attractive entry points, or trimming positions when the market is looking frothy (arguably more important as excluding the worst 10 days is actually more profitable than not missing out on the 10 best days). This is closely tied with how much you should you commit to regularly investing so that you can remain flexible enough and not be tempted to sell in bear markets.

Rule 4 - Keep an eye on costs.

There’s a fairly recent infamous story on Wall Street where Warren Buffet, regarded as one of the best investors ever, and an active investor might we add, challenged the collective hedge fund industry to a $1m bet to see if they could, after fees, beat the S&P 500, over a 10 year period. To cut a long story short, Buffet won the bet and donated his winnings to charity (read more about the story here, its actually quite an interesting one).

We are not solely passive investors and we think active investors will have their time to shine once again, but our take would be however you decide to invest, it is important to keep costs low. With the advent of technology in financial markets, such as ETFs or software tools to manage your portfolio, this is more easily done and is why we encourage people to learn to invest themselves. There’s always the stretch target of aiming to beat the index (representative of the average investor) for those who think they are up for the challenge.

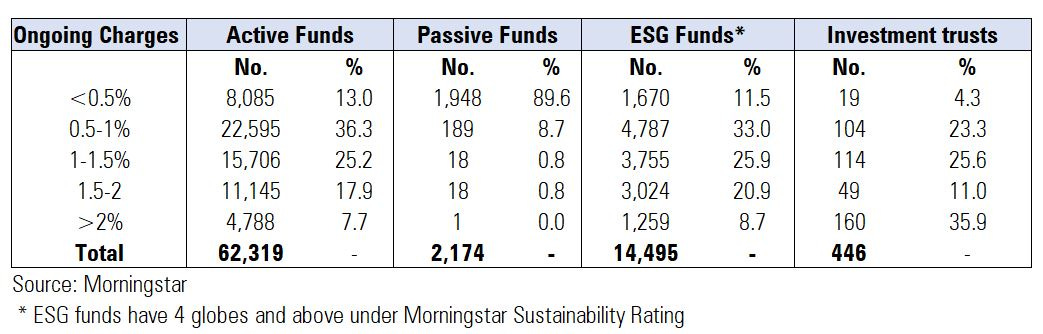

Some of the costs you will encounter while investing include one off charges like entry/exit fees or switching fees, and recurring fees like transaction costs if your broker is not commission-free, a platform charge (usually a % your portfolio value) and other administration fees like custody fees. There are recurring fees to invest in funds, measured by ongoing charges figure (OCF) in the UK or expense ratios in the US, with active funds being more expensive. Most UK active funds charge a fee of 0.5-1% while passive funds will be <0.5%, as measured by Morningstar. This may not seem like a lot but they compound over time and on top of that there are adviser fees and research fees if you rely on others to help you invest.

Rule 5 - Diversify, Monitor and Rebalance.

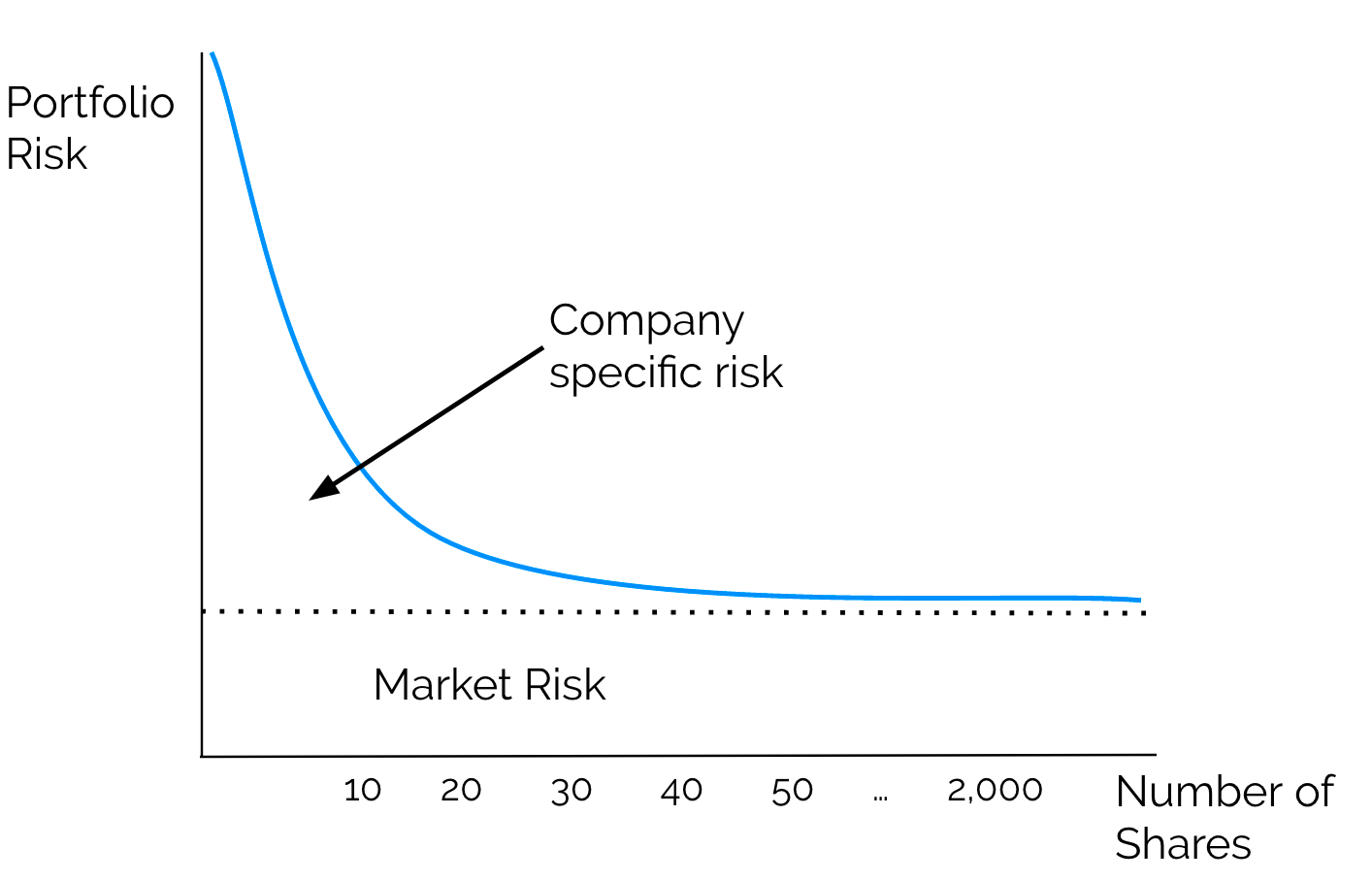

There are two main types of equity risk that investors face, market or systematic risk and idiosyncratic also known as stock-specific risk. Market risk are risks that affect all stocks such as interest rates, inflation and economic growth etc. Stock specific risk is the risk that a specific stock or industry faces. Holding a diversified stock portfolio reduces the variability of your returns by reducing stock-specific risk. This is because certain sectors or industries can exhibit negative correlation with other sectors, such that when one underperforms the other can outperform.

However, we find due to the ease of investing nowadays most stock portfolios we see have too many holdings and so are over-diversified. While that doesn’t necessarily lead to additional risk, it lends itself to higher costs and time when managing your portfolio and reduces the ability to outperform. In our approach we buy index funds to get passive exposure to various different markets (geographic regions, sectors and size i.e. small or large cap companies) and so are sufficiently diversified, but benefit from having active exposure from a concentrated number of individual stock holdings where we have high conviction. We think beyond 25 stocks held directly and not within funds, it becomes too difficult to manage and keep track of each company.

There is also greater diversification benefits to be achieved from different asset classes and thus an asset allocation is important too as mentioned in Rule 1.

‘The greatest investors make large concentrated bets where they have a lot of conviction’ - Stanley Druckenmiller

Monitoring markets is important to make tactical decisions or sell a stock that no longer fits your investment thesis or if a better opportunity presents itself. One reason we think this holds weight is because of the momentum and valuation factors that play in markets. Research suggests momentum holds over a 6-12 month period, that is stocks which are rising/falling in price tend to continue that momentum in trending markets, while the valuation factor which has even stronger research backing it, posits that cheaper stocks offer greater returns and expensive stocks offer lower returns, but this plays out over longer time periods. These factors can be conflicting at times (but no one said investing was easy!), however monitoring your portfolio for these factors as well as upcoming news and events which may impact your holdings allows you to make risk management decisions.

Another more practical reason to monitor your portfolio is because of the need to rebalance at least annually. Rebalancing is bringing your portfolio back to its initial weights which were set based on the aim of achieving its initial objectives, granted your personal circumstances and thus objectives haven’t changed. For example, if you were lucky enough to hold 5% of Nvidia a year ago, while the rest of your portfolio delivered a solid 10% return, the weight of Nvidia in your portfolio would have ballooned up to 14% which is a very concentrated position. Naturally, you would then be thinking off reducing Nvidia back to a more reasonable weight. We tend to keep an individual stock weight at below 8% of our portfolio. The same should be done to asset classes, and within equities, not just individual stocks but in funds and sectors, and again taking into consideration momentum and valuation factors but also your fundamental thoughts on whether a stock, sector or fund has further to go. We will discuss in later posts the drivers of stock prices and markets more generally (it ties in with philosophy and strategy piece we spoke about in part 1 of this post here).

Hope you enjoyed the 2 part post. Look out for the next Monthly Market review (I may tie February and March together - its been so busy welcoming so many new subscribers!)

We have also set up Instagram and X accounts to help spread the newsletter and help more Islamic investors! Please give us a follow.

See you in the next one, Salaam and Peace!

Join the community of informed Islamic investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on the most important investment insights.

If you found today's edition helpful, please consider sharing it with your family, friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Some great advice for beginners! Thanks