Month in Review (Jan 2024) and Portfolio Positioning

Bottom up, top-down and Islam in the Markets

Salaam and Peace to all,

My first stock market monthly review with 3 simple sections (Bottom-up, Top-down and Islam in the Markets). And some recommendations from interesting things I’ve watched, heard or read.

Let me know what you think and please hit the subscribe button so that I can deliver more updates going forward.

oh but first…performance

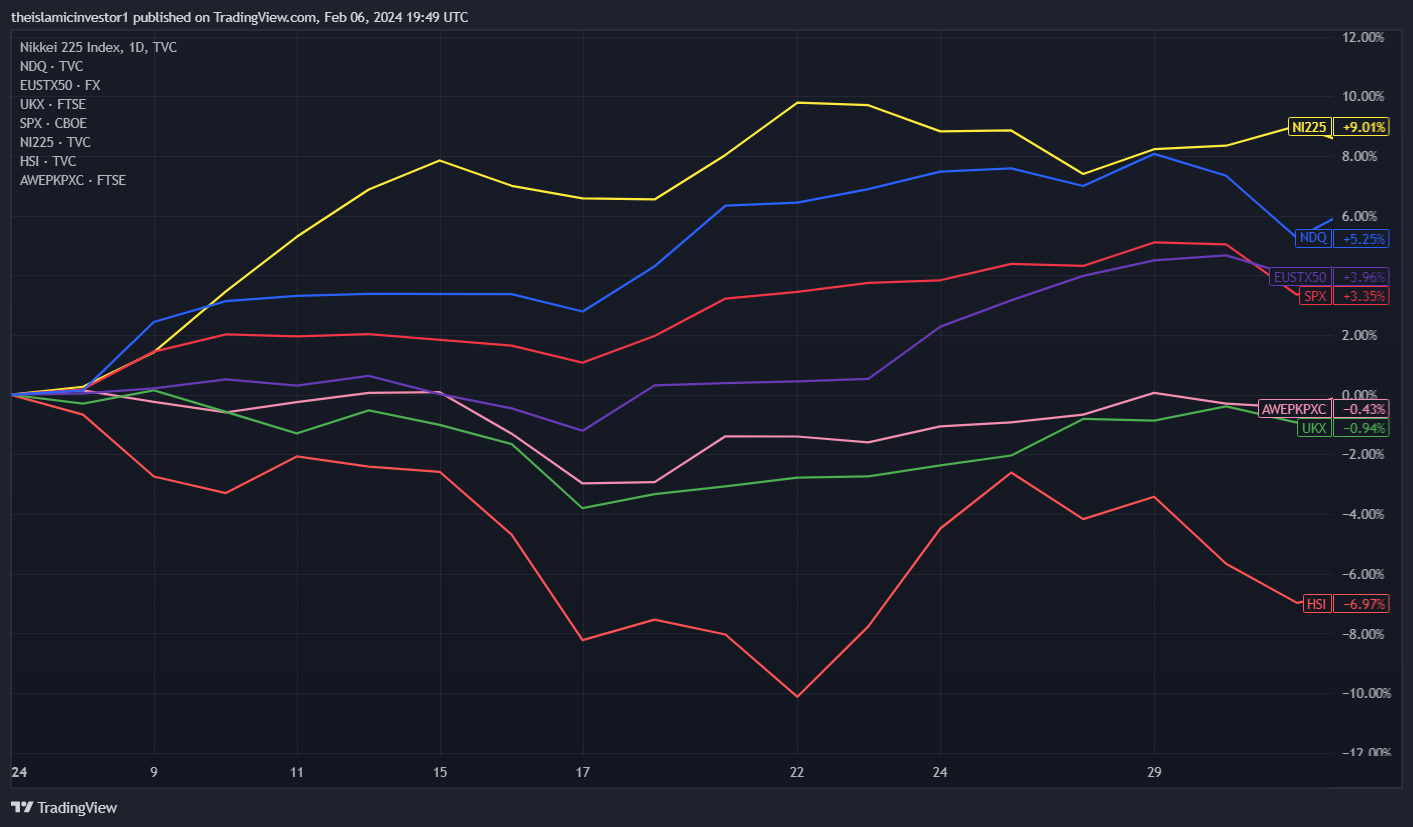

Performance of World Indices - January 2024

Nikkei 225 +9%, Nasdaq +5%, Euro Stoxx 50 +4%, S&P 500 +3%,

Emerging Markets ex China -0.5%, FTSE 100 -1%, Hang Seng -7%

1. Bottom-up

We are stock pickers after all so we have to start from the ground and see what the latest is from companies.

We had over half of the S&P 500 companies report including Big Tech with varying share price reactions. I am becoming more mindful of the concentration and valuation of Big Tech in indices and thus I am reallocating into more diversified alpha exposure into cyclical value stocks. This short interview sums up a bit of my thinking. Morgan Stanley's Wilson on Stock Picker Opportunities

2. Top-down

Since October, equity markets have mostly been supported by expectations of interest rate cuts and that was no different in January. However looking at valuations, I think the market has got a bit ahead of itself now, so I will only be putting 50% of my usual monthly deposit into stocks and leaving the rest in a savings account for a better entry point...

3. Islam in the markets

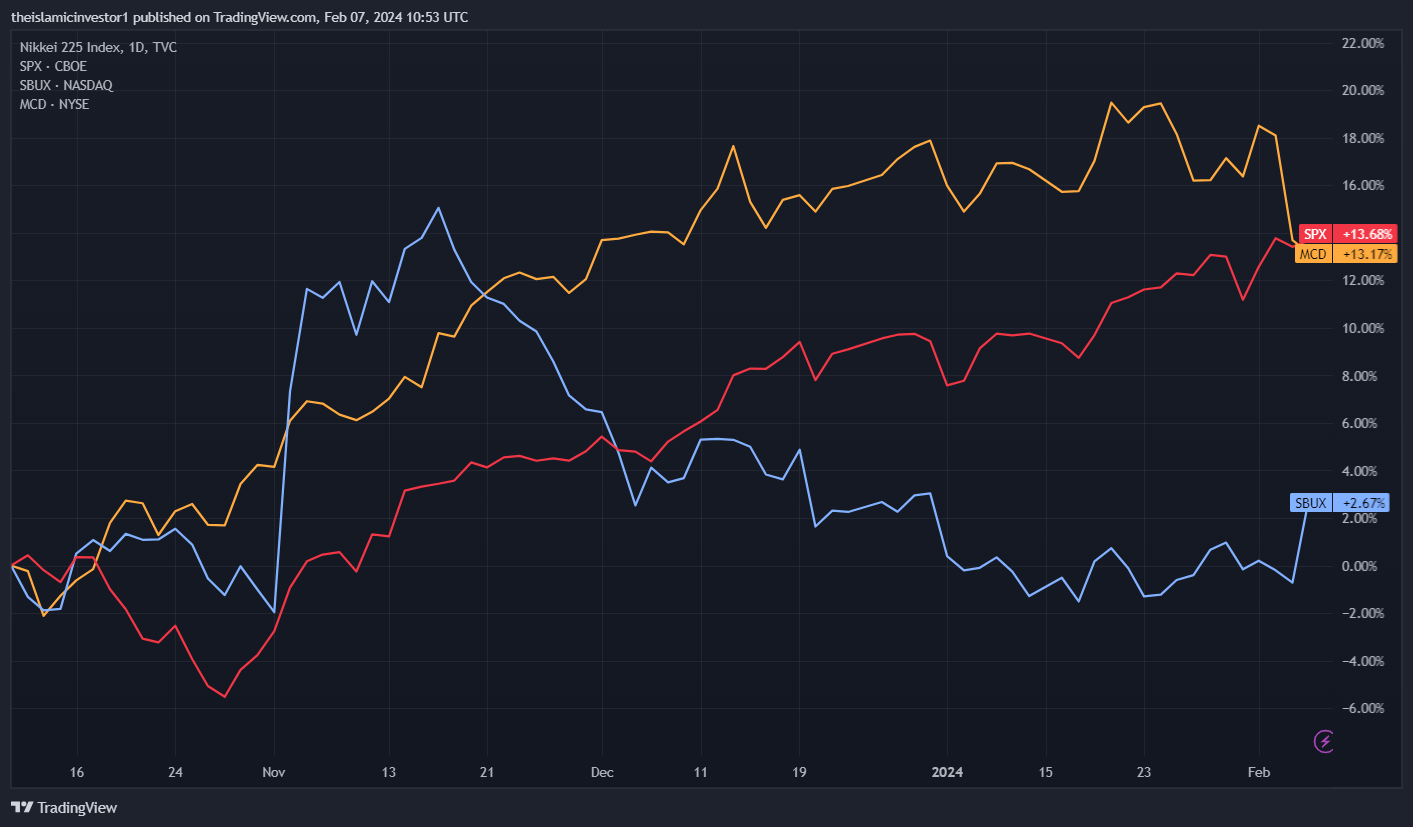

Starbucks and McDonalds quarterly results were weakened by boycotts over Israel-Palestine war. Further disruption and freight rate inflation is expected due to attacks from Houthi militia in important shipping routes.

More on each of these sections below…

…But first some recommendations…

For beginners - since it is the first monthly market review of its kind, I thought a short TedEx video explaining how investors choose stocks and the difference between active vs passive investing, which I write more about in my last post.

For experts - following Warren Buffet's increased investment in Japan last year this is a good interview discussing why the country has historically lagged other markets but why the tide may turn.

Let’s get into more detail…

1. Bottom-up

We have had around half of the S&P 500 report their latest quarterly earnings (close to three quarters by market value).

Overall earnings came in fairly strong;

Index EPS growth has been 4.4% vs the same period last year, which has beaten expectations by 5%.

However, ex Magnificent 7 stocks index EPS growth was closer to -4%

c.79% of companies beat consensus estimates at the EPS level against a 10yr average of 70% of companies beating estimates.

US 'Big tech/Magnificent 7' companies reported their 4th quarter 2023 earnings releases which mostly beat estimates (Tesla and Alphabet the exceptions) but price reaction was varied due to comments on future outlook (Apple citing China weakness). Thus, I am trimming passive exposure in favour of active exposure and I am particularly looking at more cyclical value stocks due to stronger economic growth - see Top-down section below. I'll also be dropping my monthly deposit to 50% of my usual amount. I topped up Alphabet as I felt the sell off was unfair. I write more detailed thoughts on each stock for paid subscribers.

2. Top-down

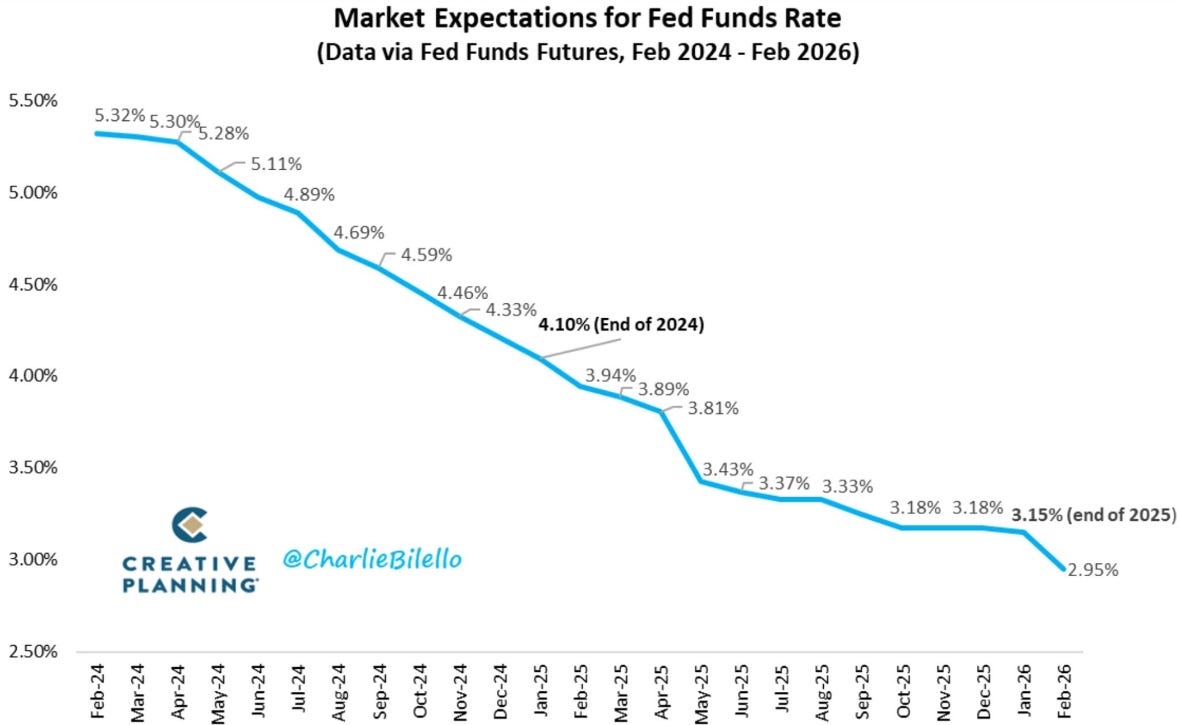

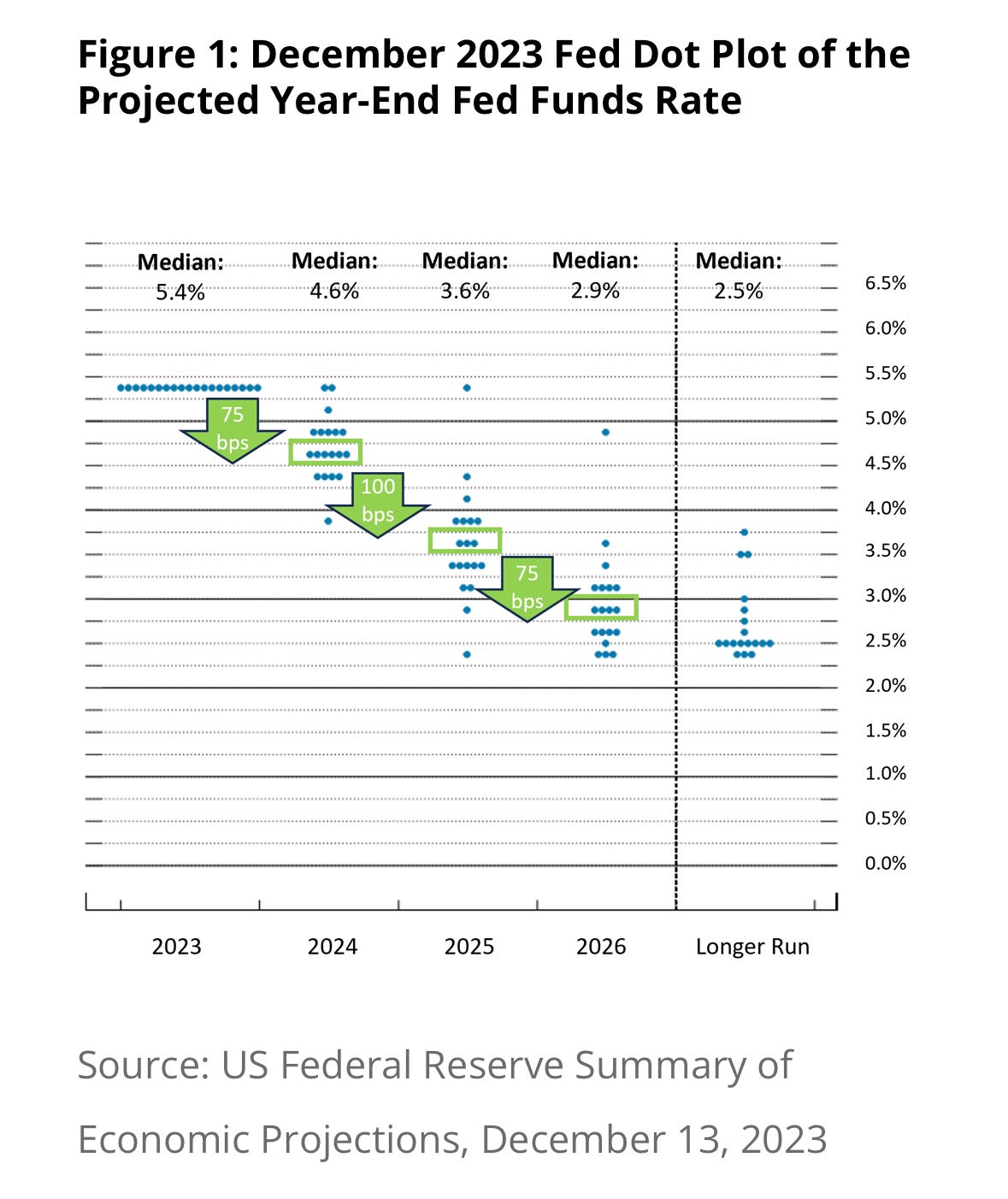

Lower interest rate expectations has driven much of the performance for markets (along with the AI and obesity drugs themes) but current market expectations for future rates (4.1% by end of 2024) are well below that of the Fed's own dot plots (their expectations are for 4.6%). The 2 charts below show the difference.

Since then we have heard from Fed Chair Powell who reiterated there will be no rate cuts in March and this is likely down to the month's strong releases for quarterly economic growth (3.3% vs expectations 2.6%) and jobs report (353k and December was revised higher too, up 115k). Services and manufacturing PMIs were also better than expectations, with the latter now looking like it has bottomed. For these reasons I expect cyclical value stocks to outperform. Cyclical stocks tend to outperform in a stronger economic growth environment, while Value stocks are better off in higher rate environments and thus should do better if inflation falls more slowly than current expectations.

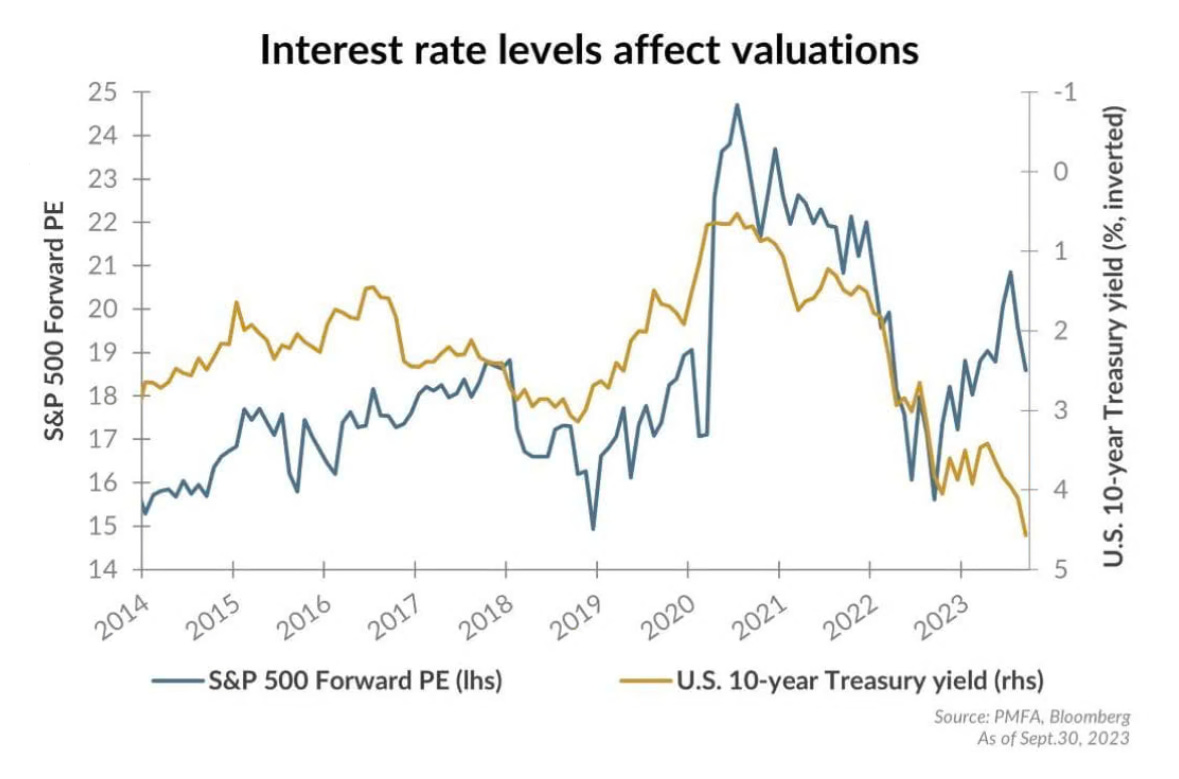

Rates are important because of their impact on valuations. This is a slightly out of date chart but shows the recent disconnect likely due to market participants expecting those interest rate cuts and getting more optimistic.

Risks to my view

Geopolitical risks. Ongoing tensions in the Middle East could impact growth and also cause spikes in inflation which would keep interest rates higher for longer.

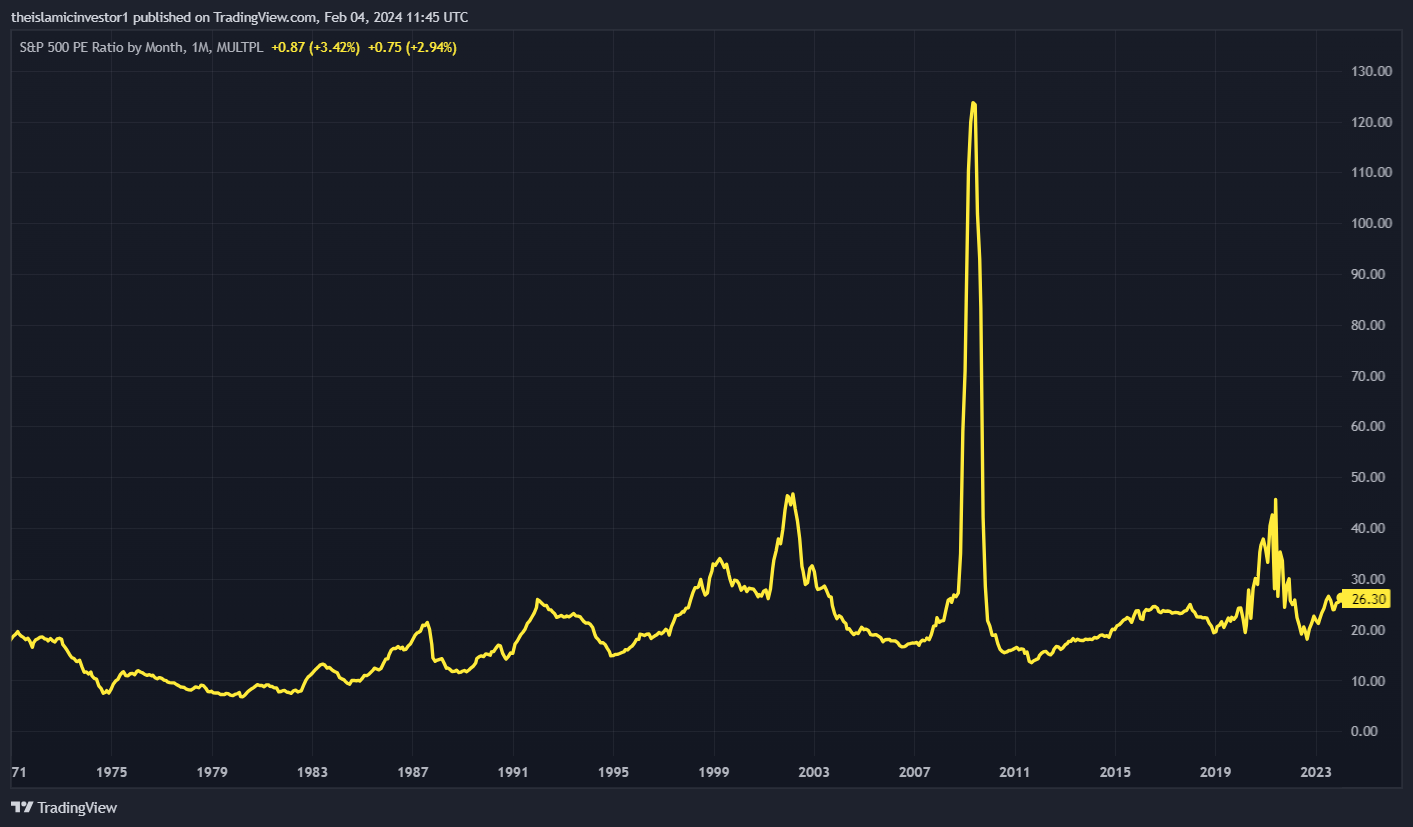

Earnings risk. Looking at valuations we are in elevated territory compared with the post Global Financial crisis period. The valuation premium of the Tech sector is back at peaks last seen during the tech bubble of the late 90s/early 00s, so I don't expect any major re-rating to come from there. Thus more emphasis will be placed on earnings delivery.

S&P 500 historical trailing PE looks elevated.

3. Islam in the markets

We heard earnings results from Starbucks and McDonalds this week. Both reports highlighted the impact of boycotts on their respective businesses and both missed revenue expectations marginally (<2%) leading to falls in share prices (2-3%) post results. While the Middle East and other Muslim majority locations are likely only a small part of their respective businesses, the demand destruction the war has caused was enough to move earnings marginally more negative, against a backdrop of weakening demand anyway, due to a tougher consumer backdrop. Since the onset of the war both stocks have underperformed the S&P 500 (McDonald’s by 0.3% and Starbucks by 11%)

Starbucks became a target of boycotts when Starbucks Workers United, which represents hundreds of the chain's unionized cafes, posted in support of Palestinians, leading to backlash. Starbucks sought to distance itself from the tweet, which the union deleted, and sued Workers United due to damage to its reputation.

McDonald's faced boycotts after their licensee in Israel offered discounts to Israeli soldiers during the war.

Elsewhere, the war continues cause disruption and likely delays for companies with supply chains exposed to the area. Freight rates have more than doubled since the start of the year as the West's response to Houthi attacks in the Red Sea has added to the impacted Suez Canal since the onset of the war. The latest estimates from the OECD said this could add 0.4% points to year on year inflation, which is quite scary, particularly for European importers. However, the shipping industry is in a state of overcapacity which should shield freight rates rising further and so the inflationary risk is not in the OECD's base case. Something to watch closely and note if companies mention it in their earnings calls.

Hope you enjoyed this post. Again, please reach out theislamicinvestor1@gmail.com if you would like me to expand/clarify on anything and if you have any feedback on how I can improve these pieces going forward.

Thanks,

the Islamic Investor

Enjoyed reading and I’m learning lots. Looking forward to the next month’s